The Essential Guide to Forex Trading: Strategies and Insights

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies with the aim of making a profit. This market operates 24 hours a day, five days a week, and is one of the largest and most liquid financial markets in the world. With a daily trading volume exceeding $6 trillion, Forex trading provides vast opportunities for traders, ranging from individuals to multinational corporations. In this guide, we’ll explore key concepts, strategies, and the importance of platforms such as forex trading acev.io to help you navigate this exciting field.

Understanding the Forex Market

The Forex market is where currencies are traded. Currencies are quoted in pairs, such as EUR/USD, where the first currency (EUR) is the base currency and the second (USD) is the quote currency. Traders analyze currency movements to speculate on their value, aiming to profit from price changes. Understanding the different types of analyses—technical, fundamental, and sentiment analysis—is crucial for making informed trading decisions.

Types of Analysis in Forex Trading

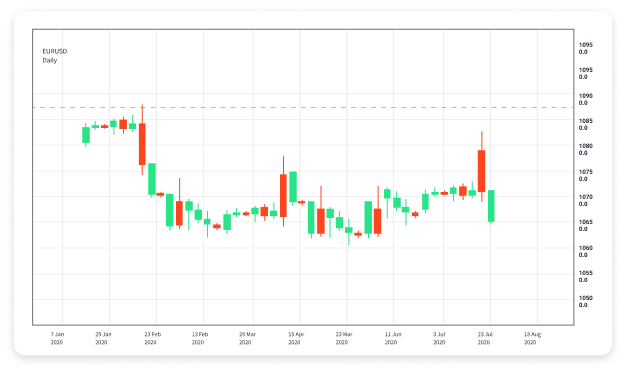

1. Technical Analysis: This method involves analyzing historical price data to forecast future price movements. Traders use various tools such as charts, indicators, and patterns to identify trends and potential entry/exit points.

2. Fundamental Analysis: This approach looks at economic indicators, news events, and geopolitical stability to evaluate currencies’ value. Factors such as interest rates, inflation, and employment figures play a significant role in currency valuation.

3. Sentiment Analysis: This analysis gauges the market’s mood or emotional state. Understanding how other traders feel about market conditions can provide insights into price movements.

Key Forex Trading Strategies

Successful Forex trading often relies on the application of effective strategies. Here are some popular Forex trading strategies:

1. Scalping: This strategy focuses on making small profits from tiny price movements. Scalpers often enter and exit trades quickly, holding positions for a few seconds to a few minutes.

2. Day Trading: Day traders hold positions within the same trading day and avoid overnight exposure. This strategy requires a keen sense of market movements and quick decision-making.

3. Swing Trading: Swing traders hold trades for several days to capitalize on expected price shifts. This strategy relies on both technical and fundamental analysis.

4. Position Trading: Position traders maintain long-term trades based on fundamental analysis. This strategy involves fewer trades but requires significant patience and a solid understanding of market trends.

Managing Risk in Forex Trading

While Forex trading can be highly profitable, it also involves considerable risk. Effective risk management is key to becoming a successful trader. Here are some tips for managing risk:

1. Set Stop-Loss Orders: Use stop-loss orders to limit potential losses on trades. Setting a stop-loss order at a certain percentage below the market price can help protect your capital.

2. Use Leverage Wisely: Leverage allows traders to control large positions with a small amount of capital. However, it can amplify both profits and losses. Be wary of using too much leverage.

3. Risk Only What You Can Afford to Lose: Never invest money that you cannot afford to lose. A sound trading plan includes setting aside a budget specifically for trading.

Choosing a Forex Broker

Choosing the right Forex broker is vital to your success as a trader. Here are some key factors to consider:

1. Regulation: Ensure that the broker is regulated by a credible authority. Regulation adds a level of security to your funds and trades.

2. Trading Platform: A user-friendly and reliable trading platform can enhance your trading experience. Look for platforms that offer advanced charting, technical analysis tools, and fast order execution.

3. Account Types: Many brokers offer multiple account types with varying spreads, leverage, and commissions. Choose a brokerage that suits your trading style and goals.

4. Customer Support: Opt for brokers that provide excellent customer support to assist you with any issues you may encounter.

Forex Trading Psychology

Psychology plays a significant role in Forex trading. Traders often face emotional challenges, including fear and greed, which can result in poor decision-making. Here are some tips to maintain a healthy trading mindset:

1. Stick to Your Trading Plan: Have a clear trading plan and adhere to it, even in the face of emotional turmoil.

2. Keep a Trading Journal: Document your trades, strategies, and emotional responses to various market conditions to identify patterns and improve your decision-making process.

3. Take Breaks: Avoid overtrading by scheduling regular breaks. This allows you to reassess your strategies and avoid emotional trading.

Conclusion

Forex trading is a complex yet rewarding financial activity that requires careful planning, continuous learning, and disciplined execution. By understanding the market, applying effective strategies, managing risks, and maintaining the right mindset, traders can increase their chances of success. As you embark on your Forex trading journey, consider utilizing platforms like acev.io to enhance your trading experience and access valuable resources. Remember, the key to long-term success in Forex trading is to remain patient, emotional discipline, and a constant willingness to learn.